Imagine walking into your brand-new home for the first time.

Every detail is exactly how you dreamed it, and it has that new house smell.

But getting to the finish line isn’t a walk in the park. You’re faced with endless choices, hidden fees, and questions you never thought to ask.

We’ve got your back.

From choosing a builder and picking a floor plan to budgeting for upgrades and understanding the fine print, the home-building process can feel like a full-time job.

The following questions will help you filter through the noise.

Unlike buying a resale home, building a brand-new home involves a unique set of steps, vocabulary, and decisions.

Choosing the right builder? Tricky.

Navigating financing incentives? Confusing.

Design center decisions? Endless.

Asking the right questions is key to making an informed decision and avoiding nasty surprises.

This guide is designed to help you ask the essential questions when buying a new construction home.

Whether you’re selecting floor plans, comparing standard features, or walking through a model home, we’ll cover everything you need to feel confident in your home-building process.

Key Questions to Ask Before Building Your Home

We’ll explore what to ask at every step, including:

- Questions to ask your mortgage lender

- Builder financing & incentives

- Choosing the perfect lot

- Lot features, premiums, and deposits

- Designing your floor plan

- Builder warranties

Whether you’re considering a custom home builder or a big-name production builder, these questions are what we cover with all of our new construction buyers.

These are the most important questions to help you build your dream home without regrets:

Mortgage Questions to Ask Your Lender

1. How much money should I put as a down payment?

Understanding your budget is the first step in buying new construction.

Consider how much money you could put down without stretching yourself thin.

Look at your savings, retirement accounts, and any gifts you could use from family members.

2. What will my monthly mortgage payment be at different price points?

Think about the monthly amount you’d be willing to spend on mortgage, insurance, property taxes, and HOA assessments.

Ask your lender how your ideal monthly payment translates into a purchase price.

Related: Best Mortgage Lenders in St. Louis

3. Can I begin the construction process without selling my current home? (if applicable)

If you have a current home to sell, determine if you can close on your new home without selling it, or if you’d need to be contingent on your home closing.

Your lender can discuss options with you, like recasting and bridge loans.

4. What loan product could I use for this home? (Conventional, FHA, VA, USDA, etc.)

Talk to your lender about what loan type and amount would be ideal when your construction loan converts into a fixed mortgage at closing.

5. What closing costs can I roll into the loan?

Ask about title fees, loan origination fees, underwriting fees, builder fees, and anything else that you could potentially roll into your loan.

Related: How to Lower Your Closing Costs

Interest & Payment Structure

6. When does my interest rate lock in? What happens if construction is delayed?

Your interest rate may not lock in until you’re within 30–60 days of closing.

If your build takes longer, ask your lender about extended rate lock options and how much they cost.

Unfortunately, you run the risk of a fluctuating interest rate while your home is under construction.

You won’t know your final interest rate until later in the construction timeline.

7. What will my payment structure look like while the home is under construction?

Most builders require you to put money down up front to begin construction, but you won’t have a 30-year fixed loan until closing.

You may be using a construction loan with interest-only payments during the build.

Ask your lender about payment,s so you know what to expect.

8. Is this a single-close construction-to-perm loan or a two-time close?

A single-close loan means your financing converts automatically to a regular mortgage at the end of construction.

A two-time close means you may need to re-qualify and pay closing costs again when your new-build home is complete.

Financial Questions to Ask Your Builder

9. Can I finance with my own lender?

Some builders strongly encourage you to use their lender, but you can usually choose your own.

Some incentives may be tied to using the builder’s preferred lender, but be careful.

Builders might advertise “financial incentives” that come with higher fees and interest rates.

If the builder is being pushy about using their lender, and it makes you uncomfortable, they may not be the right builder for you.

10. What incentives do you offer to finance with your lender instead of mine?

Builders may offer thousands of dollars in closing cost credits or upgrades if you use their preferred lender.

But weigh these perks against interest rates and fees. Sometimes the builder’s lender charges additional fees elsewhere.

Read the fine print.

11. Can I close with my own title company?

Builders often want you to use their title company, but you usually have the legal right to choose your own.

Be sure to ask about this up front, especially if you have a preferred title company or want to compare closing costs.

If you’re using your own lender, they may have a title company they prefer to close with.

12. What incentives do you offer to close with your title company instead of mine?

Like lenders, builders may offer incentives to close with their preferred title company.

However, their title fees may be higher than the market average.

Compare total closing costs before deciding on a title company.

Deposits

13. How much is the construction deposit?

Most builders require a construction deposit due at contract signing.

The deposit is often 5% to 10% of the base price. Sometimes it’s a flat dollar amount like $10,000 or $25,000.

This secures your lot and starts the permitting process.

14. Is the construction deposit refundable under any circumstances?

Ask what happens if you change your mind, can’t get financing, or need to cancel the contract.

Some builders refund deposits under very specific conditions; others consider them non-refundable.

15. Can I finance any part of the construction deposit?

In most cases, the construction deposit must be paid out-of-pocket and upfront.

Still, it’s good to ask if any part can be rolled into the loan or covered through builder incentives.

Pricing

16. When is the sale price of the home locked in?

Some builders lock the price when you sign the contract, while others may not finalize pricing until you’ve selected all upgrades.

Ask when the base price and any options become contractually locked.

You’ll want to know the final cost of the home early on, so there’s no surprise later.

17. Could the price increase during construction? If so, when and how will I be notified?

Some builders include cost escalation clauses allowing price increases due to materials or labor costs.

Understand what scenarios could trigger a price change and how much notice you’ll get.

The cost of construction can increase for many reasons:

- Delayed build time

- Weather

- Supply chain issues

- Material shortage

- Labor shortage

18. How much of a financial buffer should I include if costs increase?

It’s smart to set aside extra funds for unexpected costs, typically 5–10% of your budget.

This gives you flexibility if you discover upgrades you want later in the process or if costs rise.

19. How much do buyers typically spend on upgrades in this subdivision?

Ask your builder (or your agent) for typical upgrade ranges in the neighborhood.

In our experience, buyers spend 20-50% above the base price when factoring in lot premiums, structural changes, and design selections.

If you go heavy on upgrades, the total cost of your home might double the base price.

Some builders have a lot of upgrades baked into the base price, while others will nickel and dime you for every upgrade you want.

Related: Do You Need a Realtor for New Construction?

20. Do you currently have any promotions or discounts on base prices or upgrades?

Builders may offer limited-time discounts, upgrade packages, or interest rate buydowns.

Some builders offer seasonal promotions around holidays.

Look out for these discounts because sometimes that’s how you can get the best deal on your new house.

Check Builder’s Track Record

21. How do you ensure consistent quality control during construction?

Good builders follow rigorous inspection processes internally. They should clearly outline how they guarantee their work at each stage:

- Foundation & framing inspections

- Pre-drywall quality checks

- Final walkthrough

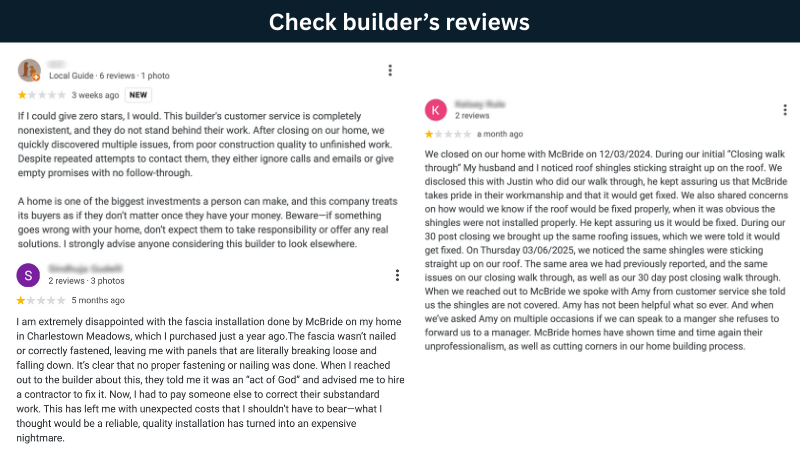

22. How can I verify your reputation and quality standards?

Check your builder’s reputation by asking:

- How long have you been in business locally?

- Can I tour recently completed homes or speak to past clients?

- Do you have references and online reviews available?

Working with the right home builder will save you time, money, and headaches.

Make sure to check their reviews online, too! See what previous clients really have to say about the builder.

If you want to see all the builders in your area, check your local home builders’ association.

Choosing the Perfect Lot

23. How many total lots will be in this neighborhood?

Understanding the full scope of the community can help you plan for future traffic, noise, and resale value.

A 30-lot subdivision will feel very different from one with 300 lots.

24. Are there unreleased lots in future phases? When will they become available?

Many builders release lots in phases when building in a large subdivision.

If nothing fits your needs now, ask about upcoming phases.

You might be able to reserve a lot early in the future or get on a priority list to secure a lot that’s the right fit for your needs.

Lot Restrictions

25. Are some lots reserved for specific home series, floor plans, or price ranges?

Certain lots may only allow a specific type of home (e.g., ranch vs. 2-story) or floor plans from a particular series.

Smaller lots will restrict the square footage of the home that can be built.

Always ask what’s allowed on the lot you’re considering.

26. Are there restrictions on what model or front elevation can be built based on neighboring homes?

How your home looks is an important consideration. Builders often avoid placing the same elevation side-by-side.

This is to minimize how “cookie-cutter” a neighborhood feels.

Sometimes builders also restrict the construction materials you can use on the exterior so that neighboring homes don’t have the same colors and finishes.

Ask if your preferred building materials are allowed on the exterior.

27. Do some lots restrict the floor plan I can build?

Narrow lots or lots with easements may not support larger floor plans or a 3-car garage.

Ask what structural options will or won’t work on your lot.

28. Can the floor plan be flipped or rotated on this lot?

You might want to reverse the layout of a floor plan (e.g., garage on the left instead of the right).

Depending on the lot shape and utility lines, this may or may not be possible.

29. Are there setbacks, easements, or utility access restrictions I should be aware of?

Easements, sewer lines, setback requirements, and neighborhood guidelines may limit how much of the lot you can build on.

Ask for a copy of the plot plan to understand the buildable area of the lot.

30. Are there any manholes, drains, or utility boxes located on this lot?

These features can impact where you place landscaping or patios, and some buyers find them unsightly.

Walk the lot and ask if there are any public utility features to consider.

Lot Features, Deposits & Premiums

31. How much is the deposit to reserve a lot? Is it refundable under any circumstances?

Most builders require a non-refundable deposit to hold a specific lot, often due when signing the purchase agreement.

Some may refund it if financing falls through or you cancel within a certain timeframe, so be sure to ask.

32. How much are lot premiums? Are they negotiable?

Lot premiums are an added cost for more desirable lots, like those backing to trees or on a cul-de-sac.

Premiums can range from $5,000 to over $100,000.

Ask your agent and builder how they’re priced and if there’s room for negotiation.

33. Does this lot have any sidewalks or street lamps on it?

Sidewalks, utility boxes, and street lights may be placed on or near your property line.

Consider how these affect your curb appeal, driveway placement, and outdoor living space.

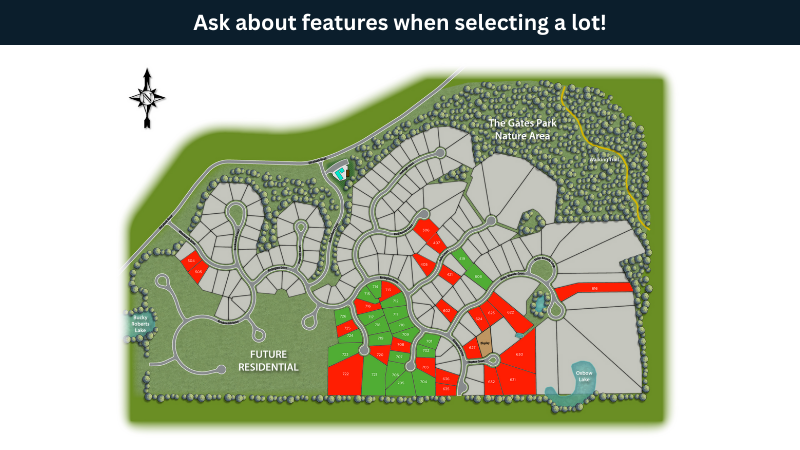

34. What lot features are available?

Desirable features often include walkout lots, tree-lined views, or location on a cul-de-sac.

Think about what kind of lot features you’d like in your new home.

Ask which lots offer these features.

Make sure to talk to your real estate agent about resale value in the area, too. Sometimes, a more expensive lot is worth the money for resale.

35. Is this lot near any neighborhood amenities?

Being near amenities can be a huge plus for daily convenience and future value.

But it may also bring more foot traffic or noise.

Ask what amenities and recreational facilities will be in this neighborhood and where these shared spaces are compared to your lot.

These amenities may include:

- Neighborhood pool

- Clubhouse

- Gym

- Playground

- Walking trails

Site & Structural Conditions

36. Will this lot require additional grading or site prep?

Some lots require extra work to level the ground, improve drainage, or prepare for a walkout basement.

These extra costs aren’t always included in the base price.

Ask for the construction site cost estimate upfront.

37. Are there additional building costs due to trees, slope, or soil conditions?

Removing large trees, managing steep slopes, or addressing poor soil quality can drive up costs quickly.

Ask the builder if any known conditions could add to your cost.

38. Is there an additional cost if you hit rock when digging the foundation?

In rocky areas, builders may charge extra if they encounter bedrock or other excavation challenges.

Ask if the builder has encountered this before in the area and how they handle those costs.

39. Has a soil test been done on this lot? If so, can I see the results?

A soil test determines how well the ground drains and whether it’s suitable for building.

Ask if one has been completed and if the results could impact the type of foundation or overall build cost.

40. Are there any known drainage issues with this lot or nearby lots?

Poor drainage can cause water pooling, erosion, or foundation issues. Ask about historical drainage concerns or if the lot needs special grading, French drains, or retaining walls.

Ask about drainage of the neighboring lots, too.

The last thing you want is to build the home of your dreams only for water runoff from your neighbor’s house to pool around your foundation and flood the basement.

Lot Orientation & Usability

41. Which direction does this lot face? (North, South, East, or West)

The direction your home faces affects sunlight exposure, driveway snow melt, and even how hot your rooms get in the afternoon.

Consider what kind of natural light you want and where you’d like it.

42. How will the sun hit the backyard and main living areas throughout the day?

A south-facing backyard typically gets more sun, while north-facing yards stay cooler and shadier.

Ask your builder or agent to help visualize sun angles at different times of day.

Careful planning can help you maximize sun exposure during those summer months if you plan on building a pool or outdoor living spaces.

43. Will the orientation impact energy efficiency or utility costs?

Homes with lots of direct sunlight may require more cooling in the summer, while shadier homes may stay cooler naturally.

Orientation can also affect energy-saving features like solar panels if that’s something you’re interested in.

Floor Plan Selection

44. Are virtual tours or 3D walkthroughs available for this plan?

If you can’t tour a model of the floor plan you want, a virtual tour or 3D walkthrough is the next best thing.

This helps you understand the layout, flow, and home design before construction begins.

45. Is there a model home with this same floor plan available to tour in this subdivision or another?

Touring a model home gives you a real-world sense of space and interior design options.

Even if the model is in another neighborhood, seeing the layout in-person helps you make design decisions.

If the model is in another neighborhood, be sure to ask if certain finishes you like are available in the neighborhood you’re building in.

If there’s no model available, ask if the builder has any move-in-ready homes (also called spec homes) that you could tour.

Designing a Home That Grows With You

46. Does this floor plan fit your lifestyle and daily routine?

Think about how you live day to day. This new home will be one of the biggest investments you’ve ever made, so it should suit your lifestyle.

Do you want an open kitchen for entertaining?

A quiet area for kids to do homework?

A cozy work-from-home area?

Guest suites?

Choose a plan that makes your daily life easier and more enjoyable.

47. Do you prefer an open-concept, traditional layout, or a blend of both?

Open-concept homes feel spacious and modern, but traditional layouts offer more separation and privacy.

Decide what suits your needs.

48. How many bedrooms and bathrooms do you need now and in the future?

Consider your current needs and future plans—whether that’s kids, guests, or multigenerational living.

A home that fits today and adapts tomorrow is a smart investment.

If you only need 2 bedrooms now but might need 4 in the future, remember you can always use those bedrooms for other purposes.

Maybe a home office? Gym? Kid’s playroom?

49. Do you want a main-floor bedroom?

A main-level bedroom can be great for easy living, hosting guests, or having space away from the kids.

It also adds long-term flexibility as your lifestyle changes.

50. Do you need a home office, flex space, or a finished basement?

If you work from home, need a playroom, or want a gym or media space, plan for it now.

It’s easier (and cheaper) to build the right space than to retrofit later.

Floor Plan Options & Flexibility

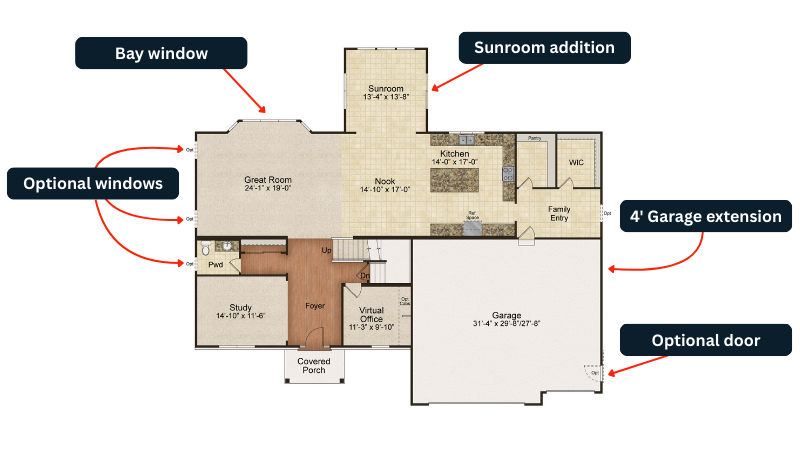

51. Can this floor plan be expanded or customized?

Some builders allow structural changes like adding a sunroom, bumping out a wall, or reconfiguring rooms.

Others only build as-designed.

Ask how much flexibility you have.

52. Can this floor plan be flipped or rotated?

Flipping the layout may improve natural light or garage access, depending on the lot.

53. What are the standard selections for this floor plan?

Each builder includes a different level of finishes (cabinets, counters, flooring, etc.).

Get a detailed list of what comes standard.

“Standard” features with one builder might be considered an upgrade with another builder. Upgrades can come with a hefty price tag, too, so make sure you know what is included and what is not.

Elevation & Curb Appeal

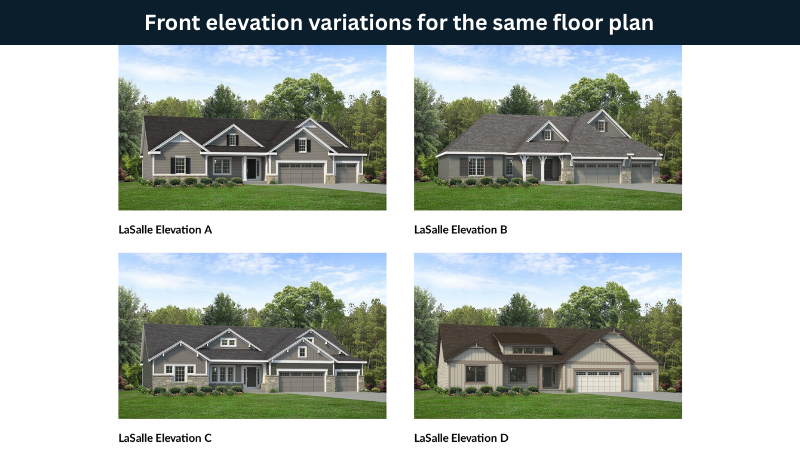

54. What exterior elevations are available for this plan?

Most builders offer multiple exterior styles or “elevations” for the same floor plan.

These elevations usually look slightly different and include different materials, like brick, stone, stucco, or vinyl.

These affect curb appeal, and they may be priced differently. Ask to see all available options and what’s included versus upgraded.

55. Are there color restrictions on the elevation based on surrounding homes?

Some subdivisions have rules to prevent homes from looking too similar. Your preferred color scheme may be limited depending on your lot and neighboring homes, so ask before falling in love with a look.

56. Are porch, garage, or roofline variations available?

These design tweaks can personalize your home’s front elevation and add charm or function.

Ask if you can choose from different porch styles, gables, or garage layouts.

57. What garage orientation is available?

Garage placement affects your curb appeal, driveway layout, and even lot usability.

Some lots may only allow front-entry garages, while others support side-entry or rear-entry designs.

Protecting Your Investment: Builder’s Warranty

58. What exactly does your warranty cover, and for how long?

Most builders offer a new home warranty, but coverage varies significantly.

Typically, you’ll see coverage for:

- Structural defects: Usually, 10 years

- Major systems (HVAC, plumbing, electrical): Usually 2–5 years

- Cosmetic items: Often 1 year

Custom-built homes may come with more warranties.

Always request a copy of the warranty up front, and read the fine print carefully. Some warranties have exclusions or limitations.

59. Are separate manufacturer warranties provided?

Appliances, roofing, windows, and HVAC systems often have individual manufacturer warranties.

Confirm these details with your builder and keep all documentation handy.

You probably won’t need them now, but you might in the future.

60. What is the process if I have a warranty claim?

Ask the builder how they handle warranty claims. How quickly do they respond? Will they fix issues themselves, or contract them out?

Home Inspections

61. Can I hire my own inspector during construction?

Even new homes should be inspected independently. Consider hiring your own home inspector during construction:

- Pre-drywall (to check framing, wiring, and plumbing)

- Post-construction, before final walkthrough (to catch finishing defects)

The final inspection is usually your last chance to notify the builder of anything you want changed.

62. What happens if the inspector finds issues?

Understand how your builder handles third-party inspection reports.

Most builders aim to deliver a final product that you’re happy with. In our experience, they are very willing to work with you on resolving any inspection items you’re unhappy with.

Confirm if your contract allows negotiating repairs before closing.

For example, if a radon test shows high radon levels, can the builder install a radon mitigation system for you?

Sometimes builders will allow you to install a radon mitigation system at your own expense, and sometimes they’ll split the cost with you.

Ready to Start Your Home-Building Journey?

The home-building process is exciting…

But it can take a long time to navigate and comes with potential pitfalls if you’re not asking the right questions.

Whether it’s understanding the base price versus the final price, confirming the completion date, or asking about the builder’s warranty and customer service, a little due diligence goes a long way.

Don’t be afraid to dig into the details.

Ask about HOA fees, warranty programs, construction quality, and even what past clients say in online reviews.

Make sure your builder has a solid track record before you sign anything!

Bringing in a realtor, researching the builder’s reputation through the Better Business Bureau, and even hiring an independent home inspector are all good ideas to protect your investment.

Building a new construction home is a significant investment.

Make sure to get your money’s worth by using this list of questions as your guide.

You’ll have peace of mind at each step of the build process.

It’s easy to get overwhelmed, especially if you’re a first-time buyer.

Need help navigating your new construction journey? Contact us today. We’d love to help you build your future home, and we are here to guide you every step of the way.