Buying a new home? It’s one of the biggest financial decisions you’ll ever make.

House hunting is overwhelming, home prices are sky-high, and getting approved for the mortgage can feel complicated.

There’s a ton of paperwork you’ll go through, answering questions about your job, assets, and income history.

The terminology can get confusing, and the numbers can be even more confusing.

You’ll want to work with a loan expert who explains home loan options in a way that makes sense, compares market interest rates, and helps you optimize your total cost (not just the rate).

Between loan types, mortgage terms, and your monthly mortgage payment, it helps to have someone walk you through it all.

That’s why we recommend working with a local St. Louis lender.

- They know the market and offer competitive rates.

- They have relationships with local agents and title companies.

- They can offer the kind of service and flexibility you won’t get with big-box lenders.

Here are 5 of the best mortgage lenders that St. Louis buyers know and trust.

Stuart Rosenblum – American Mortgage Corporation

Stuart Rosenblum has been in the mortgage business for more than 30 years.

He began his career in New York at a CPA firm after graduating from Queens College. After getting married and starting a family, he moved to Chesterfield, MO. He’s lived there ever since.

In 1994, Stuart founded American Mortgage Corporation to serve the St. Louis Metro area, including Illinois.

Today, Stuart and his son, Jordan, lead an in-house team focused on speed, customer service, and saving buyers money.

When you work with Stuart and Jordan, you’re working directly with them and benefiting from the full expertise their team brings to the table.

How is Stuart Different?

Large lenders operate in a big-box style setup, with layers of approvals, commissioned mortgage loan officers, and slow timelines.

American Mortgage Corporation is a lean, family-run business without all the bureaucracy that slows down big banks.

No middlemen: Stuart is a mortgage banker, not a mortgage broker. He underwrites and funds his own loans.

Streamlined closings: Stuart processes your loan application fast and can close a file in 10 days. Most lenders take 30 days minimum.

Extra tools. Stuart has access to both Fannie Mae and Freddie Mac underwriting systems. Most lenders only use Fannie Mae, which limits approvals. Having both means Stuart can often approve a loan where others can’t.

Having access to both underwriting systems also means more homebuyer programs you probably haven’t heard of before.

The Zero Closing Cost Loan That Saves Money

One of the ways Stuart helps buyers save money is with the Bagel Loan®, one of his most popular loan products.

Why Bagel? It’s round like a zero. With this loan, your closing costs can be reduced or completely eliminated.

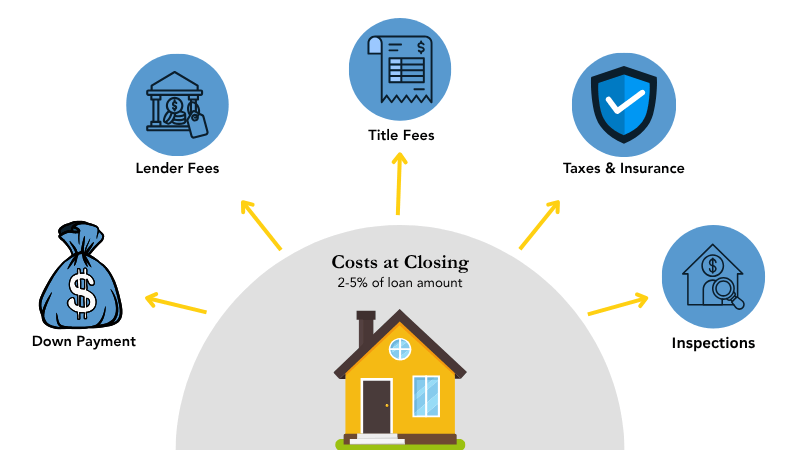

Here’s how it works: Borrowing more than $200,000? With the Bagel Loan®, Stuart covers all title fees and waives lender fees if you close with a partner title company. Even if you don’t, most costs are still covered. That can save you thousands at closing, without raising your rate.

Why can Stuart do this? American Mortgage Corporation doesn’t have commissioned loan officers. All processing and underwriting is done internally. That saves Stuart money, which means he can waive all lender fees and still profit from funding the loan.

He does all this without raising your rate or rolling fees into the loan.

The Bagel Loan® works with any type of mortgage: Conventional, FHA, VA, you name it.

You can use the Bagel Loan® in both Missouri and Illinois. It’s a simple, powerful way to make closing less stressful and save thousands of dollars in the process.

Get a Free Quote

Why Buyers Love Stuart

The #1 reason our clients choose Stuart? He saves them money.

He’s been doing mortgages in the St. Louis area for more than 30 years and handles everything in-house.

That means faster approvals, fewer headaches, and more flexibility than you’ll get from big banks.

He’s creative when it comes to saving buyers money. The Bagel Loan® is a perfect example.

Stuart can cover closing costs that would normally add thousands to your bill. And because he keeps his company lean and underwrites internally, he’s able to do this without sneaky fees or higher rates.

Personalized Approach

Stuart is personal and accessible.

He’s not passing your file between layers of loan officers, assistants, underwriters, and processors. He’s available to answer questions, explain options, and guide you through the process from start to finish.

That’s why we always recommend him to our clients and why we consider him to be one of the best lenders around!

Wait… What Happens After Closing?

If you borrow more than $200,000 using The Bagel Loan®, Stuart’s team monitors interest rates and notifies you when they drop. You can refinance for completely free, saving you even more money.

Related: How to Lower Closing Costs When Buying

Why Do Listing Agents Care About Your Lender?

When it comes to buying a home, not all lenders are created equal in the eyes of a listing agent.

It’s all about trust and reliability.

Listing agents call the buyer’s lender before advising their seller to accept an offer. They want to make sure the lender can vouch for the buyer’s ability to qualify for the loan.

If the lender doesn’t pick up the phone or can’t advocate for the buyer, it can come across as a red flag to the seller. You want a lender who can go to bat for you.

Local lenders, like Stuart, build their businesses on trust, accountability, and community connections.

They approach every deal as a reflection of their reputation, and they treat their clients like family, not a number on a spreadsheet.

Craig Wania – Gershman Mortgage

Craig Wania has been helping St. Louis buyers navigate mortgages for over 25 years.

He works closely with his colleague, Heather Lamont. While they’re listed separately on this list, they operate as a team, giving you double the expertise and support.

What Makes Craig Stand Out?

He walks you through every scenario.

Is an FHA loan or a conventional loan right for you?

Should you put down 5% or 10%?

Craig will show you exactly how the numbers shake out for every option, making complicated mortgage decisions easy to understand.

He’s not just about crunching numbers, either. Craig is approachable, easy-going, and genuinely cares about making the process as smooth and stress-free as possible.

He keeps clients informed, answers questions quickly, and even after closing, he stays connected to make sure everything continues to go smoothly.

What really makes Craig different is that he doesn’t disappear after closing.

Most lenders consider their job done once the loan is signed, but Craig stays in touch. He’s always available to answer questions, provide guidance, or help with future mortgage decisions.

He genuinely cares about his clients’ financial well-being, and that kind of ongoing support is something you just don’t get with a big-box lender.

Why Buyers Love Craig

- Clear guidance: Craig walks buyers through different scenarios, showing exactly how the numbers work. Whether you’re deciding between FHA vs. conventional or figuring out how much to put down.

- Long-term support: Unlike most lenders, Craig doesn’t disappear after closing. He stays in touch to offer advice and guidance for future mortgage decisions.

- Trusted and approachable: Working with Craig feels more like having a trusted friend in the mortgage world than just a lender.

Bottom line: Craig combines patience, clear communication, and ongoing support to make buying a home less stressful and more informed.

Heather Lamont – Gershman Mortgage

With nearly two decades of experience, Heather Lamont has built a reputation as a trusted and easy-to-work-with mortgage professional in the St. Louis region.

She works with Gershman Mortgage, which is one of the region’s oldest independent mortgage lenders.

- She’s been a licensed Loan Officer since 2006.

- Heather works with clients in Missouri, Illinois, and Colorado, offering expertise across a variety of loans: FHA loans, VA loans, USDA loans, and Conventional loan programs.

- She is committed to helping first-time buyers achieve the dream of homeownership.

What sets Heather apart is her educational approach to lending.

She doesn’t just process loans; she takes the time to explain every step, making sure clients understand their options and feel confident about their choices.

Whether someone is a first-time homebuyer or a seasoned homeowner refinancing, Heather ensures the experience is stress-free and transparent.

Responsive to Clients’ Needs

Clients describe her as responsive, approachable, and patient. She’s known for answering questions quickly and explaining everything in detail.

Have a question about your monthly payments? Personal loans? Home equity lines of credit? Cash out refinance? Heather can cover it all.

She also makes herself available beyond business hours, even evenings and weekends, so her clients’ peace of mind always comes first.

Why We Love Heather

- Takes the time to explain things: Heather explains mortgage options clearly, making complex decisions easier to navigate.

- Always accessible: Evenings, weekends, and in-between, Heather is available when clients need her.

- Relationship builder: Many clients stay in touch long after closing, turning one-time transactions into lasting connections.

Bottom line: Heather is more than a loan officer. She’s an educator, advocate, and partner in the homebuying process. With her blend of expertise, availability, and genuine care for her clients, she is a perfect addition to the Gershman Mortgage team.

Tony Roppa – Guild Mortgage

Tony is the Chesterfield Branch Manager at Guild Mortgage, where he leads his team with a focus on care, expertise, and dedication.

Tony has decades of expertise and is a trusted ally for anyone navigating the complex world of mortgages.

- Backed by 25+ years in lending, Tony brings deep knowledge and practical expertise to every client he serves.

- He has closed over $500 million in residential loans.

- Serves both Illinois and Missouri.

- With experience in both big-bank settings and more personalized environments, Tony blends broad industry knowledge with a client-first approach.

Tony began his career in the big-bank world but relocated to St. Charles, MO, in 2000, where he’s proud to call home.

He treats his clients like family, guiding Illinois and Missouri buyers through the mortgage process from start to finish.

With more than 25 years of experience in the mortgage and finance industry, he knows how to help clients navigate every step with confidence.

Tailored to Each Client’s Needs

Tony takes the time to understand each client’s unique situation, tailoring his approach to fit their financial goals. His goal isn’t just to meet expectations, it’s to exceed them.

Why Buyers Love Tony

- Personalized approach: Tony takes the time to understand each client’s unique situation and tailors his guidance to fit their needs.

- Community-minded: Tony’s connection to his family and the St. Charles community shows in the care and dedication he brings to every client interaction.

- Reliable: Clients can trust Tony to guide them every step of the way, making the mortgage process less stressful and more informed.

Bottom line: Tony combines experience, personalized guidance, and a connection to his community to make navigating the mortgage process easier and more confident for Illinois and Missouri families.

Mike Mohan – Community Mortgage

Mike Mohan is a senior mortgage consultant with Community Mortgage, a smaller, client-focused firm that helps you find the financing solution that fits your needs.

Clients consistently praise Mike for his clear communication, responsiveness, and for making the mortgage process a great experience.

Clear Communication

Mike is known for his friendly and approachable style. He takes the time to walk clients through the mortgage process, explains loan options clearly, and helps them make informed financial decisions.

First-time homebuyers, in particular, appreciate how patient he is and how he breaks down complex numbers and paperwork in ways that are easy to understand.

Why We Love Mike

- Highly accessible: Available nights and weekends to answer questions and provide guidance. Clients note that he makes himself available outside of standard business hours to ensure their peace of mind.

- Communication Style: Speaks like a friend, not a stack of mortgage jargon. He explains loan options and numbers in a way clients can truly understand.

- Extraordinary Service: Mike embodies Community Mortgage’s motto, “Lending with Extraordinary Service.” He provides a personalized experience and makes sure you feel confident about your decisions by guiding you each step of the way.

Bottom line: Mike stands out for his ability to make the mortgage process easy to understand, guiding clients step by step with clear explanations and practical advice.

Combined with his expertise and personal attention, he turns a complex process into a manageable, stress-free experience for Missouri and Illinois homebuyers with top-notch customer service.

Work With A Local Lender Over a Big Brand

These 5 lenders are 100% local, based here in the St. Louis metro area.

They can meet with you in person if needed, answer calls and texts during off-hours, and they are very involved in the whole process.

You don’t get that kind of service with a big brand like Bank of America or Rocket Mortgage.

Making Mortgages Less Complicated

In addition to getting a client-centered experience, working with a trusted mortgage company can make the process much simpler and give you confidence in your decision.

Whether you’re buying your first home, refinancing your current home, or planning a home improvement project, there’s a wide range of mortgage solutions designed to meet your unique needs.

With so many options out there, from traditional options like FHA loans, VA loans, USDA loans, and jumbo loans to adjustable-rate mortgages for those who prefer flexible loan terms and home equity loans.

Work With a Lender who Knows St. Louis

It pays to have someone with not only expertise in the mortgage industry but also an understanding of the local market.

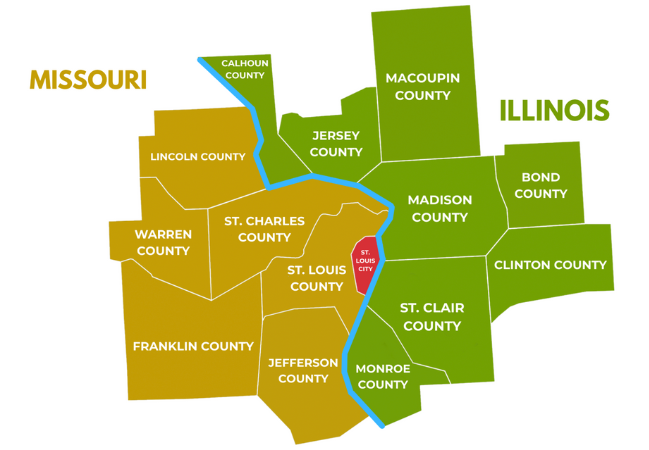

These lenders can help you buy a house in:

- St. Louis City

- St. Louis County

- St. Charles County

- Franklin County

- Jefferson County

- Metro East

…and the surrounding areas of the Greater St. Louis metro.

No matter what your situation is, working with a local lender with experience in the St. Louis housing market will make sure you have someone working in your best interests.

They’ll work with you and can explain everything from how your credit score affects your rates to what your monthly interest payments will look like, what mortgage insurance is, how mortgage refinancing works, and how credit cards can affect your mortgage preapproval.

Free tool: Use this mortgage calculator to run the numbers and see what your payment might look like.

These lenders are well-known to all our local title companies and appraisers, and they have relationships with the agents we work with, so our clients’ offers get accepted more.

Our lender partners can pull strings and give more flexibility to get your loan funded without all the layers of bureaucracy, whereas big box lenders are very cut and dry about how they do things.

Our agents at Gateway Realty Group are here to make sure you find the perfect home. These local lenders are there to make financing as painless as possible.

Ready to talk about buying a home? Work with us today!