Buying a house in St. Louis is exciting… Until you see the closing statement.

Between lender fees, title costs, prepaid expenses, and all the small line items that add up, closing costs can really sneak up on you.

For buyers, closing costs can add 2% to 5% to the home’s purchase price.

Let’s say you’re buying a $300,000 house. That means you could owe $6,000 to $13,000 at the closing table.

But here’s the thing some buyers miss: you don’t have to overpay at closing.

There are multiple ways to reduce (or eliminate) your closing costs and keep more cash in your pocket.

Here’s what we’ll cover in this guide on reducing your closing costs:

- Not everything you pay at closing is a “closing cost”

- Zero-down mortgages

- Use seller credits

- Builders offer credits too

- Apply for grants to save money

- Who pays for closing costs in Missouri?

- How much are closing costs?

Top Ways to Lower Your Closing Costs

If you’re buying in St. Louis, here are the most common ways our buyers reduce closing costs:

- Use a zero-closing-cost mortgage (like the Bagel Loan®)

- Negotiate seller credits + concessions

- Leverage builder incentives

- Apply for grants and homebuyer assistance programs

Closing Costs Explained

Closing costs include lender fees, title charges, and prepaid expenses… Not to mention all the random line items that make you think, “Do I really have to pay that?”

Not everything you pay at closing is a “closing cost.”

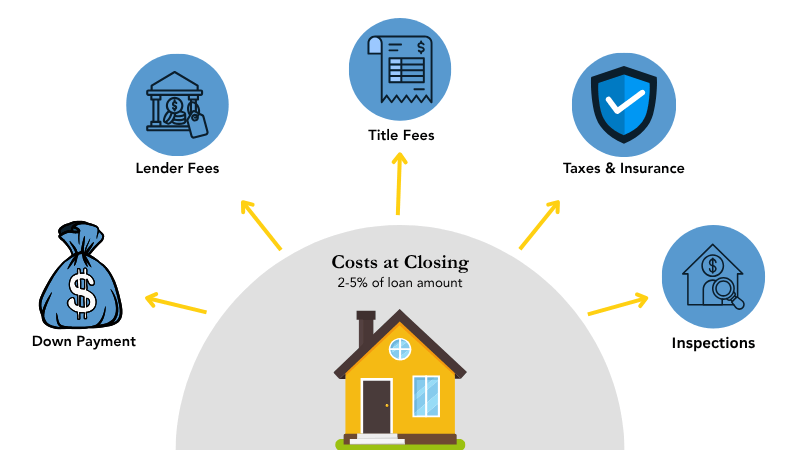

Most buyers should budget for four main costs when buying a home in the St. Louis area:

- Down payment

- Closing costs

- Prepaid taxes & insurance

- Inspections

All of these items contribute to your total cost of buying the home, but they’re not all “closing costs.”

So, What Are Closing Costs?

When mortgage lenders and title companies say “closing costs,” they are referring to fees charged by your lender and third parties to process, approve, and record the sale.

Closing Costs = Title Fees + Lender Fees

Common closing costs usually include:

- Loan origination and underwriting fees

- Appraisal and credit report fees

- Title search and title insurance

- Recording fees

- Escrow/settlement fees

- Document preparation & courier fees

- Wire transfer fees

- Miscellaneous lender fees

Other Costs Paid at Closing

While the following items are costs of buying the home, they are not considered “closing costs” from the lender’s perspective.

1. Inspection costs and reports: Building inspection, termite, radon, septic, etc. These typically cost anywhere from a few hundred to a few thousand dollars, depending on the home, its square footage, and its systems.

2. Prepaids and Escrow Deposits: Covers property taxes, homeowners’ insurance, and prepaid interest, funds your lender collects upfront to establish your escrow account.

3. Down Payment: The percentage of the home’s price you’re putting down and then financing the rest.

| Tip From The Experts: You cannot roll the down payment into your loan or use seller credits to pay for it. As the buyer, you must bring the down payment unless you’re using a 0% down conventional loan, VA loan, or USDA loan. |

How to Lower Closing Costs in St. Louis, MO

Let’s cover some of the best ways to save money on closing day.

Strategy 1: Use a Zero Closing Cost Mortgage

Yes, it’s a real thing!

But not every mortgage company offers this.

Before getting preapproved, be sure to ask your lender if they have a zero-closing cost loan option.

One of the best-kept secrets among St. Louis homebuyers? The Bagel Loan®.

It’s a zero-closing-cost mortgage created by longtime local lender Stuart Rosenblum of American Mortgage Corporation.

Why Use The Bagel Loan®?

It gets its name because a bagel looks like a zero, which is about how much you’ll pay in closing costs if you use it.

The Bagel Loan® is a signature mortgage program from American Mortgage Corporation, offered by longtime St. Louis lender, Stuart Rosenblum, to help buyers cut their closing costs.

How it works: If you borrow over $200,000 and close with a specific title company, American Mortgage Corporation covers your closing costs. This includes expenses associated with closing, such as underwriting, appraisal, title, and lender fees.

With the Bagel Loan®, you can have 0 closing costs when buying and refinancing.

Stuart has been helping St. Louis buyers for over 25 years, and his team is known for fast closings, responsive communication, and honest advice.

The Bagel Loan® has helped thousands of local families save thousands at closing, and that’s why we recommend talking to Stuart before you lock in any mortgage.

Get a Free Quote

Wait. How can Stuart pull this off?

Unlike big banks or mortgage brokers with layers of overhead and commissioned loan officers, AMC runs lean:

- Internal underwriting

- Low expenses

- Savings are passed on to buyers

That’s how Stuart can cover your closing costs while still offering competitive rates and fast closings.

“Stuart and his team did a phenomenal job helping my fiancé and I get our first home and we couldn’t be happier. The process was low stress and we were always kept in the loop and they did a fantastic job explaining everything to new home buyers.”

-Tommy R.

This can make a huge difference for first-time buyers or anyone wanting to keep more cash on hand for moving expenses and buying new furniture.

Keep in mind: Zero closing costs doesn’t mean zero money at closing.

You’ll still need funds for your down payment, prepaid taxes and insurance, and inspection fees, but the Bagel Loan® can eliminate a large chunk of fees and help you save on your new home.

It’s worth asking your lender if you qualify for something similar. Or, if you want to talk to Stuart’s team, we can connect you directly.

💡 Want to see if you qualify for The Bagel Loan®?

You can start your online mortgage application in just a few minutes, or contact our team, and we’ll connect you directly with Stuart.

Strategy 2: Seller Credits

If you’re already using a zero-closing cost mortgage loan, the next step is to pair it with seller credits.

Not every seller is willing to offer a credit, but I always say it’s worth trying to negotiate. The worst they can say is no.

Buyers typically negotiate seller credits to offset their costs related to buying the house:

- Lender fees

- Title fees

- Prepaid taxes & insurance

- Real estate agent commissions

How to Negotiate Seller Concessions

How easy it is to get a seller credit depends on 2 things:

- How the real estate market is doing

- How willing the seller is to negotiate

Negotiating seller credits is a common tactic, but you’ll see it more often in a buyer’s market.

The longer homes sit on the market, the more flexible sellers are. Right now, most parts of St. Louis are experiencing a seller’s market, but some sellers are very open to negotiating.

Credits are typically negotiated during the initial offer or the inspection period.

The biggest reason we ask for seller credits during the inspection window is if the house needs more work than the buyer expected.

Sellers might offer to cover part of your closing costs, appraisal fees, title fees, or other loan-related expenses to make their home more appealing and facilitate a smoother sale.

If you’re working with an experienced lender like Stuart or a real estate team that knows how to negotiate credits, you can often save thousands at the table.

How To Use Seller Credits Effectively:

1. Use Seller Credits to Cover Closing Costs

Seller credits are cash from the seller that goes toward your closing costs. Instead of paying thousands out of pocket at closing, the seller can cover part of those fees.

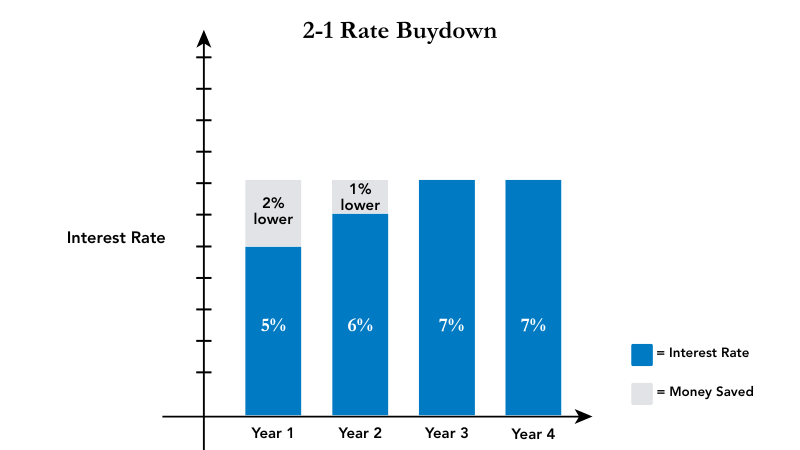

2. Use Seller Credits to Buy Down Your Rate

If the seller is offering a concession, you don’t have to use the money for closing costs. One smart option is a 2-1 rate buydown, which temporarily gives you a lower interest rate for the first two years. Then, in the third year, it jumps to the higher interest rate, unless you refinance.

For example, if your mortgage rate is supposed to be 6%, with a 2-1 buydown, it’ll be 4% the first year you’re in the house and 5% in the second. Your rate will go to 6% in the third year, but your average cost for the first 3 years of ownership will be drastically lower since you saved money in years 1 and 2.

Lower monthly payments in the first couple of years can give you some financial breathing room as you settle into your new St. Louis home.

3. Property Tax Credits and Escrow

When you buy a home, the seller reimburses you for the property taxes they’ve already accrued for the portion of the year they owned the house. That means you’re getting a built-in credit right from the start, and the later in the year you buy, the bigger that credit can be.

*Even with this credit, most buyers still need to fund a few months of taxes and homeowners’ insurance into an escrow account. Not every home loan requires this, but most do; it’s how your lender ensures that taxes and insurance are paid on time.

Limits on Seller Credits

Seller credits sound like a great way to reduce closing costs, right?

Here’s the catch: There’s a limit to how much the seller can give you at closing, depending on what type of loan product you’re using.

Limits on seller concessions are subject to change, and every lender offers different options, but generally, here are the caps on seller credits:

Conventional loans

For primary residence conventional loans, the limit typically depends on your down payment:

- Less than 10%: Up to 3% of the purchase price.

- 10–25%: Up to 6% of the purchase price.

- Over 25%: Up to 9% of the purchase price.

FHA and USDA loans

- FHA loans: Up to 6% of the purchase price or the appraised value, whichever is lower.

- USDA loans: Up to 6% of the buyer’s loan amount.

VA loans: The seller can cover all closing costs for the buyer plus an additional 4% of the loan amount that can be used to pay off the buyer’s debt (like credit card debt or loans), cover the VA funding fee, or provide a gift. Seller money used to pay the buyer’s costs associated with obtaining the loan is not counted toward the 4% limit.

Builder Credits

Maybe you have your eye on a new construction home? Don’t forget to ask about builder credits.

Some builders offer incentives to help with closing costs.

If a builder doesn’t offer credits, they may offer price reductions, free upgrades, or rate buy-downs to help buyers.

In my experience selling new construction, builders don’t offer discounts often, but if you know when to look, you can improve your chances.

Here are 3 cases when builders are more likely to offer credits:

1. At the end of the year, when builders are trying to hit their numbers before the new year.

2. When the builder is opening a new phase within a community and trying to close out the previous phase.

3. If you’re a veteran, first responder, or teacher, some builders offer credits just to say thank you.

Sometimes, builders offer incentives to cover additional costs if you use their lender.

Just keep in mind that those lenders typically charge higher rates and fees to account for the credit you receive.

Always read the fine print.

Strategy 3: Grants and Programs

Buying a house in St. Louis? Good news: There are local grants and programs you can apply for that lower your closing costs.

Live Near Your Work (LNYW) Program

If you work for Washington University or BJC HealthCare, the Live Near Your Work (LNYW) program could help you get a big boost on buying a home.

You can get a forgivable loan of up to $12,500 to use toward your down payment or closing costs in select neighborhoods.

The best part? Stay in your home and keep working for the same employer for 5 years, and that loan is completely forgiven—no payback needed.

Some of the eligible neighborhoods include:

- Forest Park Southeast

- Skinker-DeBaliviere

- Benton Park

- Dutchtown

- and a few others around the area.

*Assistance depends on the availability of funds. If all funds have been used for the year, you’ll need to apply the following year.

The Missouri Housing Development Commission (MHDC)

MHDC helps first-time homebuyers in St. Louis get a leg up by connecting them with approved private lenders.

Although they tend to help more on the down payment and tax side of things, if you qualify for any of these programs, they can be a huge help at the closing table when buying your first home.

Some of their programs are:

- First Place: Down payment assistance for qualified first-time home buyers and Veterans.

- Next Step: Down Payment assistance with higher income limits for first-time and repeat homebuyers.

Mortgage Credit Certificate: A non-refundable federal tax credit for first-time homebuyers to reduce the amount of federal income tax owed each year.

St. Louis County 1st HOME Down Payment Assistance Program

A program for income-eligible, first-time homebuyers in St. Louis County that can help with your down payment and some of your closing costs.

Beyond Housing

Beyond Housing offers a down payment assistance program to eligible residents of St. Louis County, St. Louis City, Jefferson County, St. Charles County, and beyond.

Assistance is provided as a zero percent interest, 5-year forgivable loan.

The loan amount is based on a sliding scale determined by household income.

You must be a first-time home buyer, have completed a HUD-certified Homebuyer Education course, and have undergone homeownership counseling.

South Side Spaces’ Downpayment Assistance Program

This program helps buyers afford homes in select St. Louis neighborhoods.

How it works: After renting for at least six months, you can end your lease with just 30 days’ notice and no penalties if you decide to buy a home in the City of St. Louis.

Plus, the program contributes $1,000 to your down payment if you buy in the following neighborhoods:

- Benton Park West

- Dutchtown

- Gravois Park

- Marine Ville

Who Pays Closing Costs in St. Louis, MO?

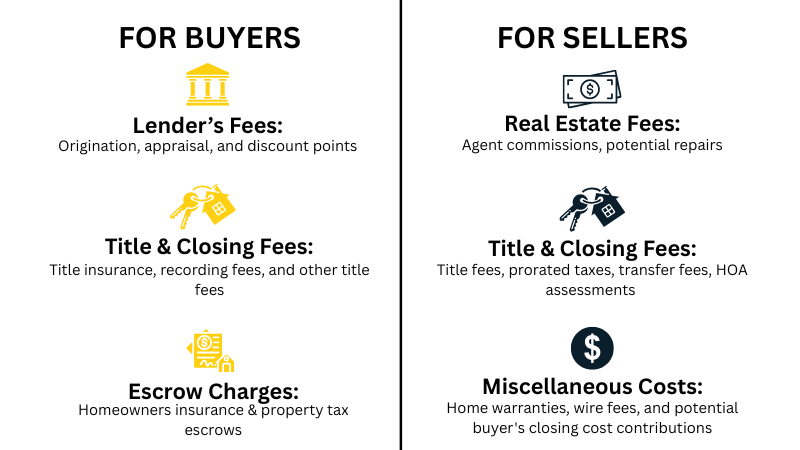

In simplest terms, the buyer is generally responsible for buyer-side closing costs, and the seller is responsible for theirs.

But that’s not a hard rule. Everything is negotiable.

Market conditions make a big difference. In a seller’s market (when houses are selling quickly and inventory is low), buyers may have less leverage to push costs onto sellers.

In a buyer’s or balanced market, sellers are more likely to agree to pay part of the buyer’s closing costs to sweeten the deal.

If a house has been sitting on the market longer and lacks interest, it’s likely the seller is willing to negotiate on the asking price and offer credits.

How Much Are Closing Costs in St. Louis?

Closing costs typically range between 2% and 5% of the home’s sale price in Missouri.

While buyers in the St. Louis area benefit from lower housing prices compared to the national average, those extra fees can still sneak up on you if you’re not prepared.

Closing costs aren’t equal between buyers and sellers. Buyer’s closing costs are typically higher than the seller’s closing costs because they have lender fees.

Here’s a breakdown of some possible closing fees depending on the home you’re buying and where it is.

Mortgage-Related Fees

Loan Origination Fees: Usually ~0.5–1% of total loan amount; covers preparing and processing your mortgage.

Credit Report Fees: Charged to pull credit reports from bureaus (doubles if two borrowers).

Private Mortgage Insurance (PMI): Required if down payment <20%; protects the lender, costs 0.25%–2.25% of the loan balance. Some loans, like FHA, require insurance for the life of the loan, regardless of equity vs. loan balance.

Real Estate Attorney Fees: Optional in Missouri; covers drafting/reviewing legal documents; varies by complexity and lawyer.

Escrow Fees: Charged by title/escrow company to manage funds and paperwork; typically split between buyer and seller.

Property-Related Fees

Title Search fees & Title Insurance: Ensures property ownership is clear; one-time payment for both buyer and lender protection.

Real Estate Transfer Tax: None in Missouri—a nice savings, since other states may charge up to $3.75 per $500 in value.

Property Appraisal: Paid by buyer; verifies fair market value before lender releases funds.

Home inspection fee: Buyer-paid; checks home condition and identifies repair or negotiation points.

Annual (Prepaid) Fees

Property Taxes: Average 1.01% of assessed home value in Missouri, per Tax Foundation. Your tax rate varies by county.

Homeowner’s Insurance: First year must be paid at closing; covers damages like fire, wind, or theft.

HOA Fees: Apply to about 1 in 5 Missouri homes; cover community maintenance and amenities. Most homes within the St. Louis metro area are within an HOA.

What Influences Closing Costs in St. Louis?

Several factors can change how much you’ll pay at closing:

Lender / Loan Product: Different lenders charge varying origination, underwriting, and processing fees. Extra options, such as discount points or rate buydowns, can also increase costs.

Loan Type: Conventional, FHA, VA, and USDA loans all have different rules regarding allowable fees and seller contributions.

Title / Settlement Company: Rates for title insurance, escrow, document prep, and closing services can vary between providers, even within the same city.

Other variables, like local taxes, recording fees, and timing of prepaids or escrow deposits, can also shift your total closing costs.

Navigating Closing Costs with Confidence

Closing costs in St. Louis can add up quickly, including buyer closing costs like lender fees, owner’s and lender’s title insurance, inspections, and prepaids, but knowing what drives these expenses can help you plan and negotiate the best deal.

On average, closing costs range from 2% to 5% of your home’s value, though your specific loan type, mortgage rates, loan term, and even your credit score can influence the total.

Seller closing costs, realtor fees, and agent commissions are also factors that may be negotiable depending on market trends and whether the seller pays part of your buyer’s closing costs.

Programs like the Bagel Loan® from American Mortgage Corporation, home buyer programs, and grants can help reduce upfront closing expenses, making the homebuying process easier for new owners.

Using tools like a closing cost calculator or reviewing your loan estimate and closing disclosure can give you a clear picture of what to expect at the closing date.

By understanding the breakdown, including HOA fees, transfer fees, and real estate agent fees, you can approach your St. Louis home purchase with confidence and make sure your money goes toward your dream home, not just closing costs.

The Bottom Line

Closing costs don’t have to drain your savings.

With smart negotiation, the right programs, and the right lender, you can buy a home in St. Louis with little to no money lost to fees.

If you’d like to explore your options (especially The Bagel Loan®), reach out to Stuart Rosenblum at American Mortgage Corporation or connect with our team at Gateway Realty Group to get started.

Together, we’ll help you save money and move into your new St. Louis home with confidence.